Business Insurance in and around Austin

One of the top small business insurance companies in Austin, and beyond.

Cover all the bases for your small business

Insure The Business You've Built.

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, trades and more!

One of the top small business insurance companies in Austin, and beyond.

Cover all the bases for your small business

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, commercial liability umbrella policies or builders risk insurance.

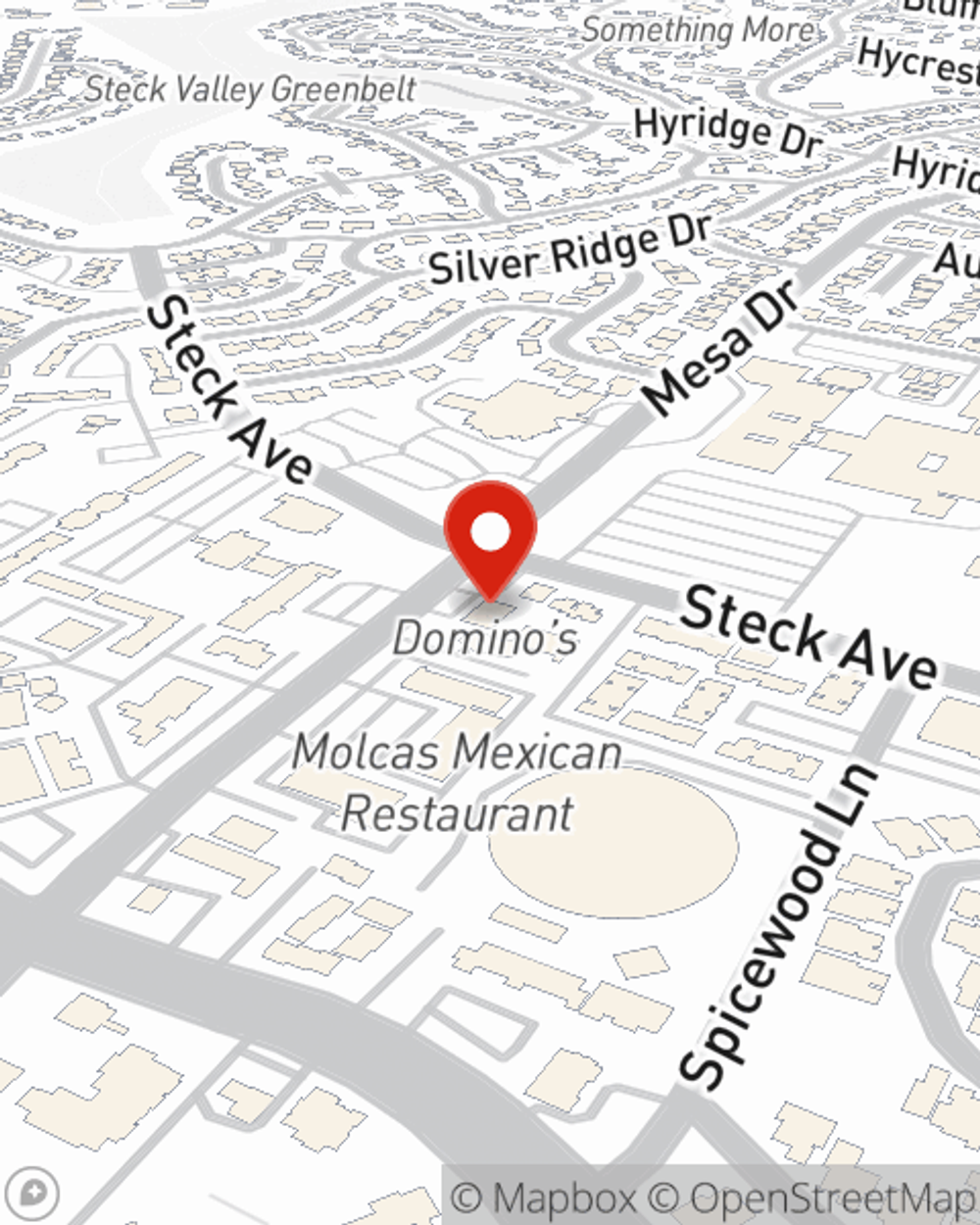

Let's review your business! Call Taylor Green today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Taylor Green

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.